Prospective Clients Feel Comfortable Being Open

Prospective Clients Feel Comfortable Being Open is a Driver of Elevation Goal 1: Making great first impressions, increasing conversion

Data based on responses to the question, asked in the First Impression review form

“Which best describes your conversation with [adviser]?”

Possible responses

I didn’t feel that comfortable being open about my situation

I felt quite comfortable being open about my situation

I felt comfortable being open about my situation

I couldn’t have felt more comfortable being open about my situation

Prospective Clients Feel Comfortable Being Open Score

Proportion of respondents answering “I couldn’t have felt more comfortable being open about my situation”

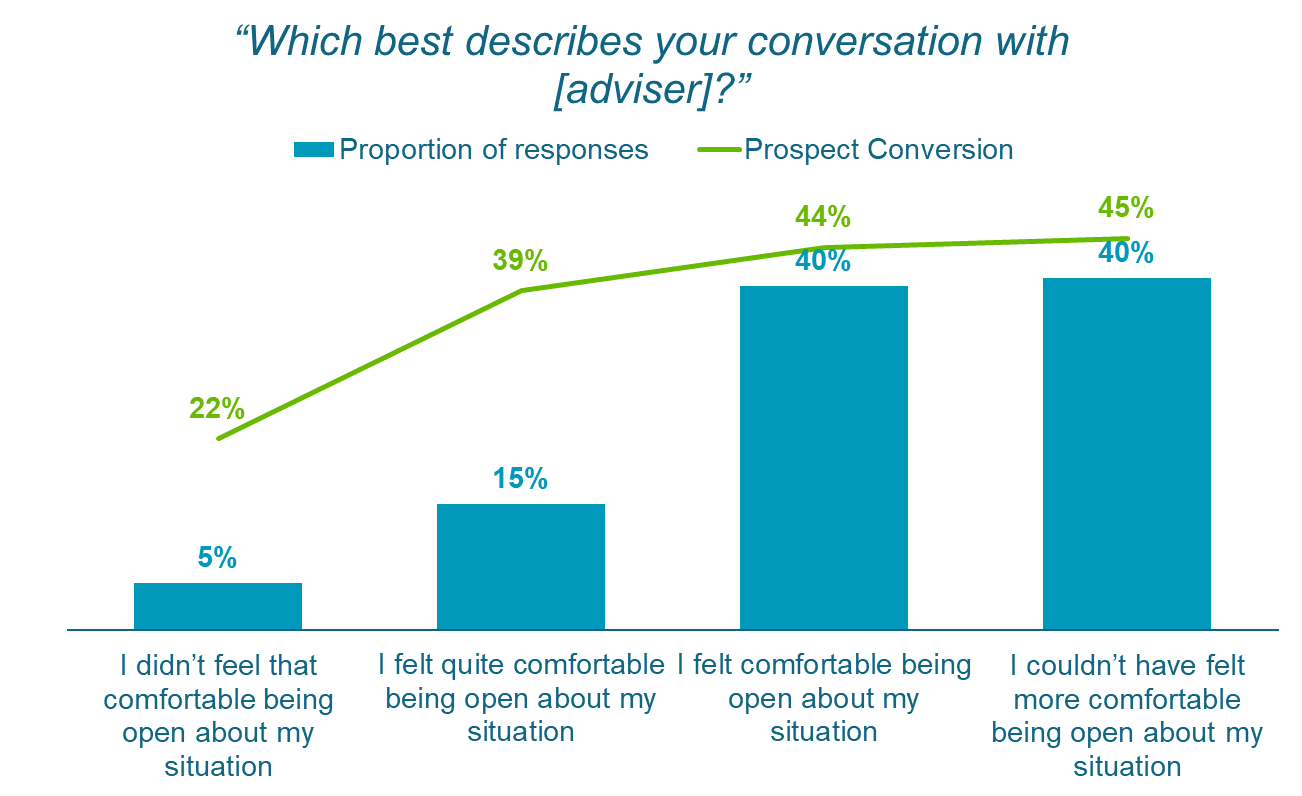

Relationship between Prospective Clients Feel Comfortable Being Open and Conversion Rate

The relationship between Prospective Clients Feel Comfortable Being Open and Conversion Rate is statistically significant

Why do we ask about Prospective Clients Feel Comfortable Being Open?

Our research with firm management teams, advisers and clients indicated that an how comfortable the client feels in the first session with their adviser is a key driver of conversion. It enables a higher quality conversation, in which the adviser learns more about the prospective client's situation and goals, and is able to be clearer about they would help.

We confirmed this relationship quantitatively through our review forms.

How Can You Improve Your Score:

Starting the conversation

Establish Rapport. Rapport extends beyond small-talk. Finding genuine common ground to talk about which connects you to your client.

Beware starting your conversation with money. This can be an immediate turn off for your prospective clients and risks a superficial conversation preventing you from understanding your client’s real motivation.

Watch Your Language. Be mindful of the questions you ask and the language you use. For example, exchange “how can I help” for “what are you looking to achieve”. This subtle change in question moves the focus away from what you can do for them and onto what they want to accomplish.

Listening and challenging

Active listening. Being conscious of your behaviour and body language when your client is talking. Active listening is a great way to show your client that you’re interested in what they have to say.

Challenge. Challenge your client’s initial goals where you see necessary. This isn’t about telling your client what they should do, but rather getting to the real reason they want to act, and helping them achieve the right outcomes.

The “5 Whys”. This is a helpful and simple tactic, where you ask why 5 times to the initial answer your client has given to get to their real motivation. For example:

“I want to invest £100,000” – why? / “I want the money to grow” – why?

Validate Understanding

Reinforce & Validate. Check your understanding regularly with your client. Say “So let me just check I’ve understood that correctly” and then repeat back what your client has just told you. This reinforces that you are interested in them as you want to ensure you get everything right.

Using these methods, you’ve got a much greater chance of your client feeling comfortable about being open with you to get the information you need to provide great financial advice.