Maximum Clarity on Mortgage Timeline

Maximum Clarity on Mortgage Timeline is a Driver of Elevation Goal 1: Making great first impressions, increasing conversion

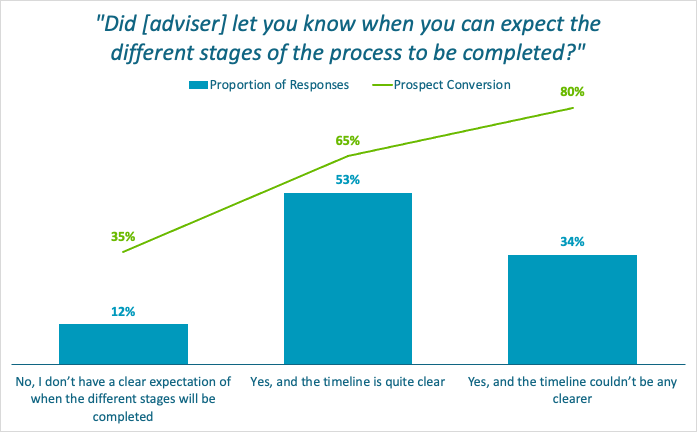

Data based on responses to the question, asked in the First Impression review form

“Did [adviser] let you know when you can expect the different stages of the process to be completed?”

Possible responses

- No, I don’t have a clear expectation of when the different stages will be completed

- Yes, and the timeline is quite clear

- Yes, and the timeline couldn’t be any clearer

Maximum Clarity on Mortgage Timeline Score

Proportion of respondents answering "Yes, and the timeline couldn’t be any clearer"

Relationship between Maximum Clarity on Mortgage Timeline and Conversion Rate

The relationship between Prospective Client Feeling and Conversion Rate is statistically significant

Why do we ask about Maximum Clarity on Mortgage Timeline?

Our research with firm management teams, advisers and clients indicated that advisers helping prospective clients feel reassured about the mortgage process can help to drive conversion.

We confirmed this relationship quantitatively through our review forms.

How to improve your score:

Break the process into stages

Whilst you can decide on the stages that work for you, an example of the stages in a first-time buyer property purchase could be:

- Finding a property (including Decision in Principle)

- Offer on property accepted and mortgage agreed (mortgage application and valuation)

- Legal work (searches, queries, and contracts)

- Exchange and completion

Each transaction type (first time buyer, sale and purchase, remortgage, product transfer, etc) has a different process. Ensure you can explain the stages of each to your client, simply and avoiding jargon.

Be clear who does what and be realistic on timescales

Buying a house can take some time – be realistic with timescales. If your client knows that the legal work stage of the process is likely to take up to 4 months, you’re much less likely to get chaser calls every few weeks asking for an update.

Anchoring is a technique where you set an initial expectation, or anchor, as to when something will happen. Once the anchor has been set, your client will judge everything in relation to it. For example:

- “The valuation could take up to 2 weeks to complete” – sets the anchor at 2 weeks. If the valuation happens in 5 days, your client will see this as exceeding their expectations and feel good about it."

- “The valuation should be completed in a couple of days” – sets the anchor at 2 days. If the valuation takes 4 days, your client will be disappointed as it’s taken longer than expected."

Create a checklist or process document

Ideally, this would be a professionally designed brochure in your company’s style, however a simple printed checklist or even including a page in your suitability report is better than nothing.

By including check boxes, clients can tick off events as they happen, keeping them involved in the process.

If they have a question about the process in future, they can initially refer to the document, rather than having to ask you.

Validate Understanding

Using stages to break down a process can make it much easier to understand than a list of tasks, as can having a visual reference, such as a brochure or checklist. The more a prospect feels like they understand what is going to happen, the higher the chance of them becoming a client.