Maximum Reassurance

Maximum Reassurance is a Driver of Elevation Goal 1: Making great first impressions, increasing conversion

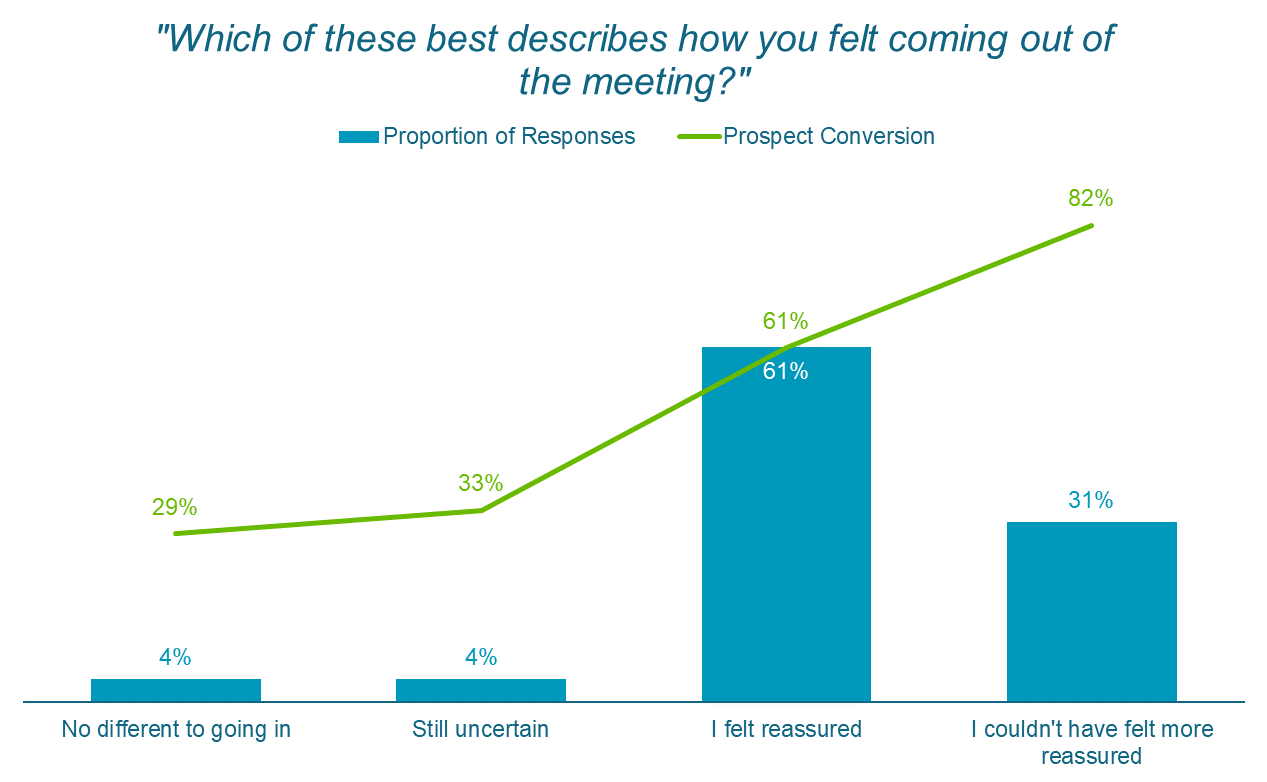

Data based on responses to the question, asked in the First Impression review form

“Which of these best describes how you felt coming out of the meeting?”

Possible responses

No different to going in

Still uncertain

I felt quite reassured

I felt very reassured

I couldn’t have felt more reassured

Maximum Reassurance Score

Proportion of respondents answering "I couldn’t have felt more reassured"

Relationship between Maximum Reassurance and Conversion Rate

The relationship between maximum reassurance and Conversion Rate is statistically significant.

Why do we ask about Maximum Reassurance?

Our research with firm management teams, advisers and clients indicated that advisers helping prospective clients feel reassured about the mortgage process can help to drive conversion.We confirmed this relationship quantitatively through our review forms.

How to improve your score:

Focus on goals, not products

Goal focused. Linking a product to your client’s goal being achieved gives them the reassurance that their goal is going to be met and produces a much greater emotional response than focusing on a product.

Mirroring. Use your client’s own language, and the drivers they have shared with you, when linking products to goals:

“Once approved, this mortgage will give your beautiful red Morgan sports car a garage, rather than it having to live under a tarpaulin on the drive.”

“Releasing this additional equity will give you the money you need to create your dream wheelchair friendly garden.”

“By transferring your mortgage, you’ll save enough money to give Lucy and Teddy another trip to the zoo each month, and an extra ice cream!”

Explain the process

Map the mortgage process. Split the process into stages when explaining it to reduce any uncertainty. As humans, we often find it easier to think about things in stages rather than a long list of tasks. By breaking the process into distinct stages, you make it easier to visualise and therefore understand.

Whilst you can decide on the stages that work for you, an example of the stages in a first-time buyer property purchase could be:

- Finding a property (including Decision in Principle)

- Offer on property accepted and mortgage agreed (mortgage application and valuation)

- Legal work (searches, queries, and contracts)

- Exchange and completion

Each type of transaction (first time buyer, sale and purchase, remortgage, product transfer, etc) will have a different process. Ensure you can split each into stages and explain them clearly.

Take the time to ensure your client is 100% clear on what’s going to happen, when, by whom and what’s expected from them.

Timescales. Ensure you’ve covered the likely timescales with your clients. It’s also better to slightly overestimate timelines than to underestimate. When it comes to feeling reassured, something happening before expected is much better than it happening later than expected.

Be clear on how you’re going to help

Explain your role. Explain what you do throughout the process to ensure that everything stays on track. It’s also worth covering that if anything doesn’t go according to plan, you’ll be in touch to help resolve any issue. The key is ensuring your client knows that you’re going to help, so they feel reassured they’re in safe hands.

Recap and validate

Recapping is a powerful tool to provide reassurance, especially when the recap includes linking actions to the client’s goals.

A recap ensures the client leaves the meeting with a mental reminder of:

- Their goals

- The best product or service to help them achieve their goal and why

- The process and timeline

- That you’ll be helping them every step of the way

Test your client’s understanding. Regularly asking a client questions on the subject you’ve just discussed. Ensure you do this from the start of each meeting; that way your client will think more tests will be coming so will really listen and therefore retain more information.

Explain back. Have your client’s explain complex topics back to you to confirm they have fully understood.

Any questions? Always close a meeting by asking your client if they have any questions, or if there’s anything else they’d like to ask. You’d be surprised how many clients leave a meeting with unanswered questions because they didn’t want to look silly asking or didn’t feel there was an appropriate time to ask in the meeting.

Relating to your client’s goals, ensuring they understand the process and how you’re going to help at every step of the way will make your client’s feel that they’re in control. Closing meetings with a recap and giving your client the time to ask any questions will create that long lasting feeling of reassurance.